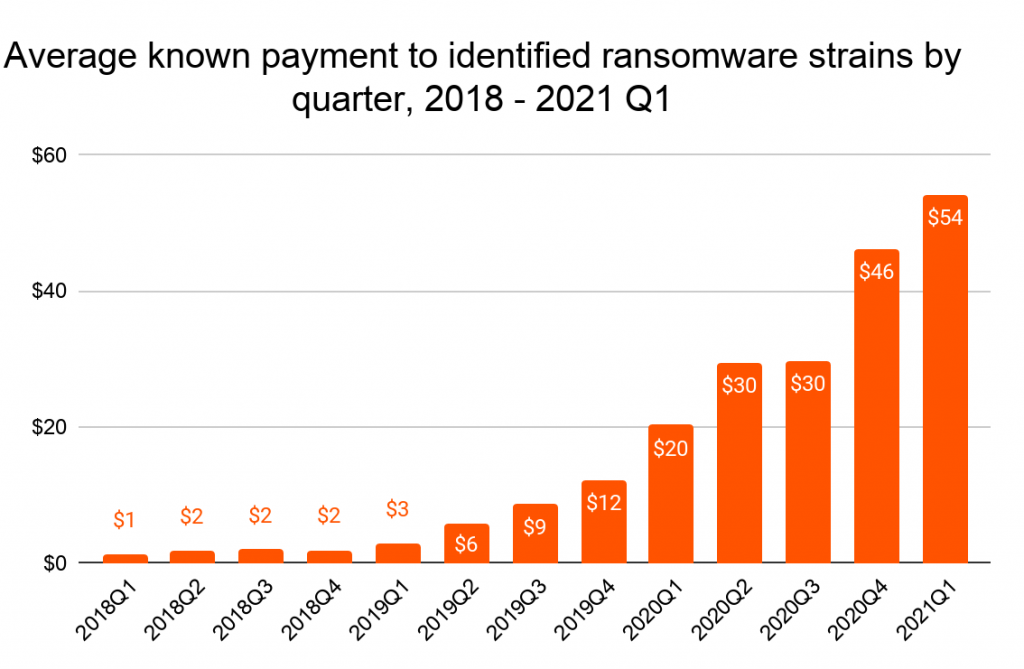

In this day and age, it seems like every time you turn around there is some sort of a report regarding cyberattacks and ransomware. As the attacks become more prevalent, Cyber Liability insurance may be something you want to consider adding to your insurance policy.

What is Cyber Insurance?

Cyber liability insurance covers some of the cost for a business to recover from a data breach, virus, or other cyberattack. Some of these costs can include the cost of notification of incident, repair of damaged software and hardware and attempting to protect the company’s reputation with a marketing and public relations response. Coverage can also include defending against lawsuits and legal claims.

Any business that stores sensitive data in the cloud or on an electronic device should have Cyber Liability Insurance. Often, a general liability insurance policy or professional liability policy will contain basic cyber liability coverage, however it is recommended if you store PII (personally identifiable information) you have a standalone or enhanced Cyber Liability policy.

As a business owner you are probably wondering why you might need cyber insurance and more importantly, worry about the additional cost and how to fit it in the budget. As we all know there are numerous factors that come into the underwriting of an insurance policy. Much like car insurance, with a blemish free driving record and more driving experience comes much lower rates than those available for an inexperienced driver with multiple speeding tickets.

Cyber insurance is no different, but instead of your driving record, it looks at the nature of your business and your current cybersecurity infrastructure. By adding effective security measures, such as installing antivirus software and network firewalls or regularly updating your passwords you can lower your premiums. In addition to making lower premiums available, some security items are non-negotiable requirements to apply. In some applications if you use Office 365 you must also subscribe to Office 365 Advanced Threat Protection, and make sure MFA was set up for all users to even be eligible for insurance.

How Can Summit help?

As an MSSP, Summit Business Technologies can provide the necessary additional cybersecurity tools, policies, and procedures to help secure your business, lower your cybersecurity premiums, or simply make you eligible for the insurance. With our team of experts at your disposal, we can help design the necessary solutions that will fit your business and meet the compliance requirements your industry may require you to meet.

As a reminder, Maryland offers a tax credit related to the purchase of cybersecurity infrastructure for your business. As a Qualified Maryland Cybersecurity Seller, certified by the Department of Commerce, Summit can assist you in gaining access to this tax credit.